What is an offset mortgage?

Buying a property or repaying an existing mortgage? Instead of a straight repayment, you can benefit from having an “offset” account linked to it, where you can put your savings and income.

The benefits of an offset mortgage

Anything you have in your offset account is taken into account when you pay your loan interest every month. That means, if you owe $250k but have $20k in your offset account, you’re effectively only paying interest on the $230k actually owed

You pay your loan off far quicker. And save $$ money $$. What about the interest you would have got on your savings? Good news. By putting your money in your offset account, you are benefitting from the rate of interest that you pay your mortgage (e.g. 4%) and also you don’t pay any tax.

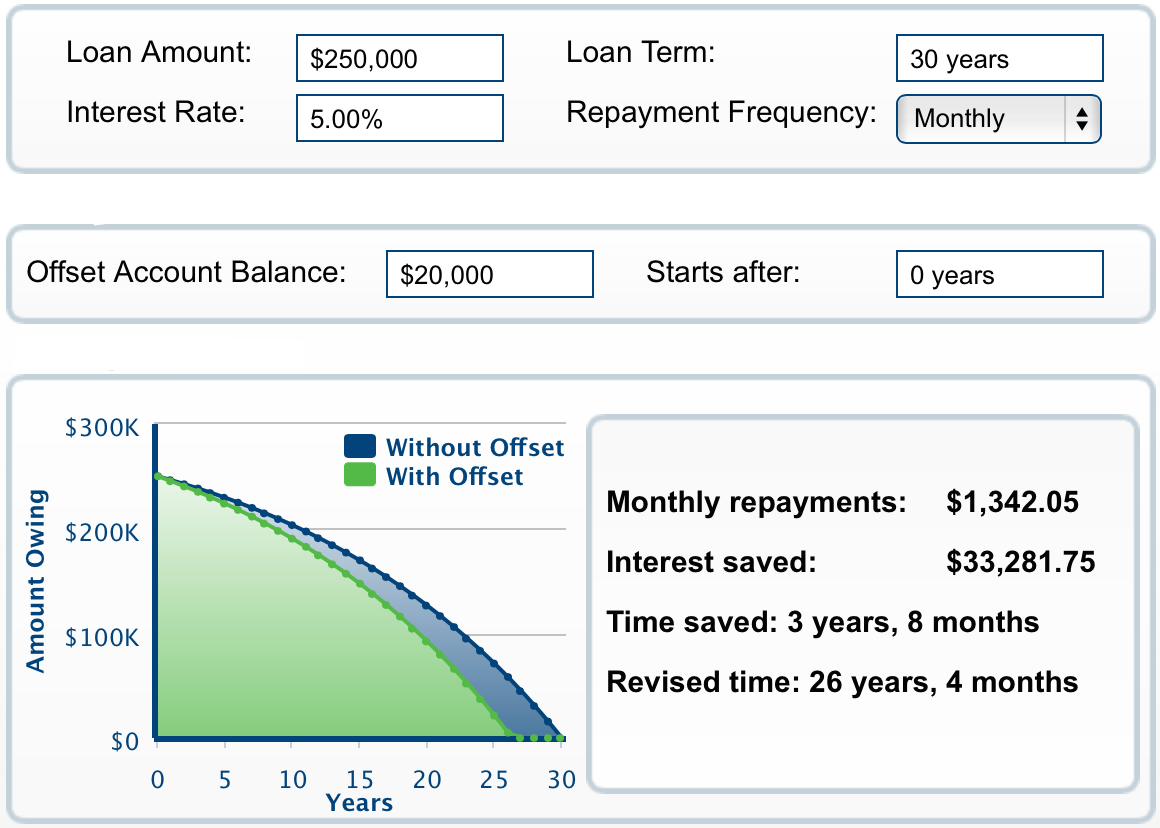

Example of a mortgage WITHOUT an offset account:

Loan amount: $250,000

Interest rate: 5%

Loan repayment: $1,342.05/month (Principal amount: $300.38, Interest amount: $1,041.67)

Loan term: 30 years

Example of a mortgage WITH an offset account:

Loan amount: $250,000

Interest rate: 5%

Offset account Balance: $20,000

Loan repayment: $1,342.05/month (Principal amount: $383.72, Interest amount: $958.33)

Loan term: shortened to 26 years and 4 months, interest saved $33,281.75!

Offsetting: a “win-win” home owner loan

Many home owners are now opting for offset mortgages due to the undeniable advantages in terms of saving money and becoming debt-free in their own homes quicker. Does that interest you? To calculate your saving, please use our Home Loan Offset Calculator.